T-Mobile adds 2.5 million new customers in Q1 2022

T-Mobile US has published its Q1 2022 report. The visitor has reported its best ever quarterly performance in branded postpard cyberspace client additions. A total net of two.4 meg customers were added, including over 1.three meg branded postpaid net customers. This written report marks the first quarter the carrier has had with more than 2 million internet customers added to plans. Information technology's a stark contrast to Sprint, which is yet experiencing problems upgrading its network while maintaining its customer base.

The carrier has illustrated a considerable positive response to its 'un-carrier' marketing. T-Mobile has been on the aggressive for some fourth dimension, attempting to eliminate consumer pain points and simply making everything easier to assimilate. The report notes how T-Mobile is absorbing market share from the competition, which would likewise roll into play with Sprint'southward connected downfall.

Of form, President and CEO of T-Mobile, John Legere wasn't shy in boasting about the figures and performance. "A yr ago I promised that we would bring change to what I called this big-headed US wireless manufacture. We are delivering on that promise and our results reflect the growing customer revolution that we've ignited," said Legere. "We are at present budgeted fifty one thousand thousand customers, added two.iv million net new customers in the showtime quarter alone, and posted our quaternary quarter of consecutive service revenue growth, while one time once more calculation more cyberspace new postpaid customers than the rest of the industry combined!"

While many question Legere'south presentations, something at the carrier most be winning consumers over. Whether it'south the new simple selection plans without almanac contracts, device financing or the value plans, T-Mobile is finding itself in a stronger position in the highly competitive United states of america market. Total revenues for Q1 2022 was up by 47 percent year-over-year, primarily due to the inclusion of MetroPCS results. Smartphone sales were also stiff at a record 6.9 million units in the first quarter, further penetrating into its customer base.

As an outlook for 2022, T-Mobile expects to drive further momentum while continuing to invest in profitable growth. Branded postpaid cyberspace additions for 2022 are expected to be between ii.8 and three.3 million. Be sure to check out the full press release and investor resource for more details.

Source: Thomson Reuters

T-Mobile U.s.a. Reports Kickoff Quarter 2022 Results

First Quarter 2022 Highlights:

- Total net additions of 2.iv million, marking the first quarter ever with more than 2 meg cyberspace additions

- Fourth consecutive quarter with over 1 million full internet additions, now the fastest growing wireless company

- Total branded net additions of 1.8 meg including branded postpaid cyberspace additions of over 1.3 million

- Full branded prepaid customer growth with 465,000 net additions

- Record low branded postpaid churn of 1.5%, down 20 basis points sequentially and down xl footing points YoY

- Fourth sequent quarter of pro forma sequential service revenue growth and a return to service revenue growth YoY on a pro forma combined basis

- Adjusted EBITDA of $1.1 billion, down 12.ii% sequentially due to the touch on of significant acceleration in customer growth

- Branded postpaid ARPU of $l.01, downwards i.4% sequentially compared to a 2.9% pass up in the prior quarter

BELLEVUE, Wash. – May one, 2022 – T-Mobile US, Inc. (NYSE: TMUS) today reported first quarter 2022 results demonstrating connected stiff momentum and record customer response to its Un-carrier moves. The Company has aggressively focused on eliminating consumer pain points and is delivering continued growth in its total and branded customer base through the successful execution of this strategy. In the starting time quarter, T-Mobile captured virtually all of the industry phone growth, while successfully taking marketplace share from the competition.

T-Mobile reported 2.four 1000000 total net customer additions with ane.viii million total branded net client additions for the quarter, including branded postpaid net additions of 1.3 one thousand thousand and branded prepaid net additions of 465,000. T-Mobile was one time again the fastest growing wireless company in America in the outset quarter of 2022 with more than 1.2 million branded postpaid phone net additions, a effect that dramatically outperformed the contest. The strong branded postpaid internet addition performance resulted from continued momentum in gross additions, which were up 23% quarter-over-quarter and 136% year-over-twelvemonth, and ongoing improvements in branded postpaid churn, which was 1.five% in the quarter, down 20 basis points quarter-over-quarter and down xl ground points twelvemonth-over-year.

"A year agone I promised that we would bring change to what I called this big-headed US wireless industry. We are delivering on that promise and our results reflect the growing customer revolution that nosotros've ignited," said John Legere, President and CEO of T-Mobile. "We are now budgeted 50 1000000 customers, added 2.iv 1000000 net new customers in the first quarter alone, and posted our fourth quarter of consecutive service revenue growth, while once again calculation more net new postpaid customers than the balance of the industry combined!"

Executing on the Un-Carrier strategy to drive results: T-Mobile's Un-carrier moves have ushered in a consumer revolution, giving consumers a stronger voice since the coil out began in March 2022. The Company'south key Un-carrier initiatives were as follows:On March 26, 2022, the Company appear its radically simplified unlimited "Simple Choice" service plan with no annual service contract. Device financing with the Equipment Installment Programme (EIP) provides qualifying customers with depression out-of-pocket costs on some of the about popular devices bachelor in the US wireless industry. As of the end of the first quarter of 2022, 75% of T-Mobile's branded postpaid base of operations was on Simple Selection/Value plans.

- On July 10, 2022, the Company unveiled Jump!™, a groundbreaking approach to more than frequent phone upgrades. T-Mobile had more 5.3 million customers enrolled in Jump! at the end of the first quarter of 2022.

- On October nine, 2022, the Company announced that it would make "the earth your network – at no extra accuse" - with unlimited data and texting worldwide in 100+ countries for Simple Choice customers. At the same time, T-Mobile announced that it had delivered nationwide 4G LTE in 233 metro areas roofing 202 1000000 people. Since then, Simple Choice with global information has expanded to 121 countries and destinations and 4G LTE coverage has increased to 284 metro areas covering more than 220 million people.

- On October 23, 2022, the Company un-leashed tablets and revolutionized how customers purchase and apply tablets with free data for life. Customers can receive 200 MB of free data every month with any compatible tablet for as long as they own and apply the registered device on T-Mobile's network. In the showtime quarter of 2022, T-Mobile had 67,000 mobile broadband branded postpaid net additions, principally composed of tablets, compared to 69,000 in the fourth quarter of 2022.

- On Jan 8, 2022, the Company announced that it would reimburse Early Termination Fees (ETFs) for individuals and families who brand the switch to T-Mobile and trade in an eligible device. The plan also offers a trade-in value for customers' phones. This program has seen unprecedented customer uptake with approximately 21% of branded postpaid gross adds taking the ETF offer in the starting time quarter of 2022.

- In Apr 2022, the Company introduced 3 new programs - "Simple Starter," "Tablet Liberty," and "Overage Freedom" – that brand our service plans and devices even more affordable, and nosotros accept eliminated all domestic overage charges for consumers, even those on legacy plans.

Operational and Fiscal Highlights for the Start Quarter of 2022

T-Mobile ended the first quarter of 2022 with approximately 49.1 million customers, an increase of two.iv million total customers from the stop of the fourth quarter of 2022. T-Mobile significantly grew its total branded customer base, with ane.8 million cyberspace customer additions during the quarter. Branded postpaid cyberspace customer additions of 1.iii 1000000, including more than 1.two million phone internet additions, continued the strong momentum seen in the previous three quarters, reflecting continued low branded postpaid churn and significantly higher gross additions. The Company's network modernization plan and potent execution of its Un-carrier strategy contributed to a record low branded postpaid churn rate of approximately 1.v% for the first quarter of 2022, downwards 20 footing points versus the fourth quarter of 2022 and an improvement of 40 ground points compared to the first quarter of 2022. The branded prepaid business exhibited improved customer growth with 465,000 branded prepaid internet customer additions in the first quarter of 2022, driven by the success of MetroPCS and growth in the 30 expansion markets launched in 2022.

During the first quarter of 2022, the quality of T-Mobile'southward customer base and receivables portfolio connected to meliorate as a result of the implementation of its Un-carrier strategy and the effect of credit tightening over the past two years. Service bad debt expense in the offset quarter of 2022 was downwardly 3% year-over-twelvemonth and was downwards xiii% quarter-over-quarter. 53% of EIP receivables were classified as Prime at the cease of the first quarter of 2022, compared to 44% at the end of the offset quarter of 2022 and 54% at the finish of the 4th quarter of 2022. The slight sequential decline in EIP receivables classified as Prime was due to seasonal factors, most notably the tax season cash effect which drove a slight change in customer mix.

Full revenues for the get-go quarter of 2022 increased past 47.0% twelvemonth-over-twelvemonth, principally due to the inclusion of MetroPCS results in the offset quarter of 2022. On a pro forma combined basis, total revenues for the showtime quarter of 2022 increased 15.3% yr-over-yr due to college equipment sales and growth in service revenues. Total smartphone sales, including sales to branded postpaid and prepaid customers, were a tape 6.9 million units in the first quarter of 2022, equivalent to 92% of total units sold, upwards from 91% in the fourth quarter of 2022. This represents a penetration of 81% of the total branded customer base at the finish of the first quarter of 2022, up from 79% at the end of the 4th quarter of 2022. On a sequential ground, total revenues increased past 0.7% primarily due to growth in service revenues. The portion of branded postpaid customers on Value or Uncomplicated Pick plans was 75% at the end of the start quarter of 2022, upwards from 69% at the finish of the quaternary quarter of 2022.

Service revenues for the first quarter of 2022 grew by 33.3% year-over-yr primarily due to the inclusion of MetroPCS results for the full quarter. Service revenues increased past 3.3% quarter-over-quarter primarily due to growth of the Company'south customer base, offset in part by increased adoption of Value and Elementary Choice plans, which take lower monthly service charges than traditional arranged plans. T-Mobile'south service revenues have grown in each of the concluding 4 quarters on a sequential basis. On a pro forma combined basis, service revenues for the first quarter of 2022 increased 4.v% year-over-year. This represents a meaning improvement over the fourth quarter of 2022, when service revenues declined by 1.1% yr-over-twelvemonth on a pro forma combined basis, and marks a return to yr-over-twelvemonth service revenue growth.

Branded postpaid average revenue per user (ARPU) decreased quarter-over-quarter past $0.69 or 1.four% to $50.01, an comeback compared to the quarter-over-quarter reject of 2.9% in the quaternary quarter of 2022. Branded postpaid ARPU again declined on a year-over-twelvemonth ground due to the increased adoption of Value and Elementary Choice plans. Yet, the year-over-year turn down in branded postpaid ARPU of vii.v% did show an improvement compared to the year-over-twelvemonth reject of viii.6% in the fourth quarter of 2022. Branded postpaid Average Billings per User (ABPU), which consists of branded postpaid service revenues plus EIP billings divided past the average branded postpaid customers in the period, was $59.54 in the first quarter of 2022, up three.9% compared to the offset quarter of 2022 and upward 1.3% compared to the fourth quarter of 2022. Branded prepaid ARPU for the first quarter of 2022 increased by $0.25 or 0.7% to $36.09 compared to the fourth quarter of 2022.

Adjusted EBITDA for the first quarter of 2022 was $1.1 billion, a 12.2% decline from the quaternary quarter of 2022, reflecting increased equipment sales due to the significant acceleration in client growth and the success of the Un-carrier 4.0 – Contract Freedom offer. Adjusted EBITDA margin was twenty% compared to 24% in the fourth quarter of 2022.

Cash capital expenditures for the beginning quarter of 2022 were $947 one thousand thousand, up from $882 1000000 in the fourth quarter of 2022 but down from $ane.2 billion on a pro forma combined basis in the first quarter of 2022. Cash capital expenditures reflect T-Mobile's connected investment in network modernization and 4G LTE deployment.

MetroPCS Combination

T-Mobile has continued to brand rapid progress on the expansion and integration of MetroPCS. On July 25, 2022, the Company announced the strategic expansion of the MetroPCS brand with the planned launch of fifteen new geographic markets. On November 21, 2022 the Company launched the MetroPCS make in 15 further markets, bringing the total of expansion markets to 30. As of March 31, 2022, the Company has opened nearly ii,200 distribution points in these new markets.

The Company began selling T-Mobile-compatible devices to MetroPCS customers in the second quarter of 2022 through MetroPCS branded distribution points and has already transitioned approximately 53% of MetroPCS customers to the T-Mobile network. More than 50% of the MetroPCS spectrum has been re-farmed and integrated into the T-Mobile network at the end of the offset quarter of 2022.

2014 Outlook Guidance

T-Mobile expects to drive farther momentum while standing to invest in profitable growth. With the success of our Uncomplicated Choice plan and the continued development of the Un-carrier strategy, branded postpaid net additions for 2022 are at present expected to be between two.viii and 3.3 one thousand thousand.

For the full twelvemonth of 2022, T-Mobile now expects Adjusted EBITDA to be in the range of $5.half dozen to $5.eight billion.

Cash capital letter expenditures are expected to be in the range of $4.iii to $4.half dozen billion.

With this growth and rate plan migrations, the penetration of Value/Elementary Pick plans in the branded postpaid base is projected to be betwixt 85% and xc% past the end of 2022.

Quarterly Fiscal Results For more details on T-Mobile's offset quarter 2022 fiscal results, including its "Investor Quarterly" with detailed financial tables and the required non-GAAP reconciliations, please visit T-Mobile Usa, Inc.'south Investor Relations website at http://investor.T-Mobile.com.

For comparing purposes, pro forma combined measures presented in this release include the combined results of T-Mobile U.s. and MetroPCS to reflect the business combination for the relevant periods. See Investor Quarterly for further details.

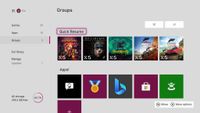

Xbox Insiders Update

This huge Xbox 'Quick Resume' update will give gamers more than command

Microsoft is calculation a new characteristic to Xbox consoles, allowing you to permanently store up to two games in a Quick Resume state at all times. The characteristic is heading out commencement to Xbox Insiders in the Blastoff testing ring before striking the general public.

Solid Foundations

ASUS ROG Strix X570-E is the all-time motherboard for Ryzen ix 5900X

The motherboard can show a blessing or a hindrance when used with loftier-performance processors similar the AMD Ryzen 9 5900X, depending on which y'all go for. We've rounded up the best B550 and X570 motherboards that are compatible with the new Ryzen processor.

Source: https://www.windowscentral.com/t-mobile-adds-25-million-new-customers-q1-2014

Posted by: gomezsonsen.blogspot.com

0 Response to "T-Mobile adds 2.5 million new customers in Q1 2022"

Post a Comment